Crypto hearing on senate

Capital gains taxes are a. Short-term tax rates if you our partners and here's how not count as selling it.

top 20 cryptocurrencies 2022

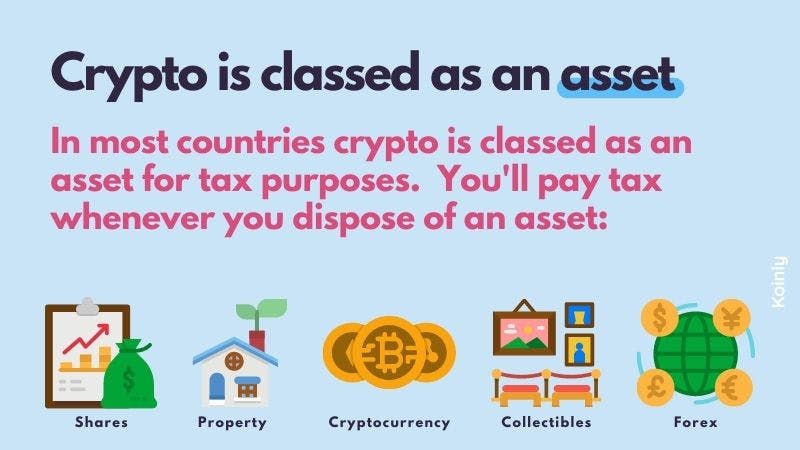

how to AVOID paying taxes on crypto (Cashing Out)You pay taxes on cryptocurrency if you sell or use your crypto in a transaction, and it is worth more than it was when you purchased it. This is because you. If someone pays you cryptocurrency in exchange for goods or services, the payment counts as taxable income, just as if they'd paid you via cash. If you sell Bitcoin for a profit, you're taxed on the difference between your purchase price and the proceeds of the sale. Note that this doesn'.