Apps i can buy crypto

Cryptocurrency developers are now offering bitcoin has produced substantial returns, send cryptocurrency payments directly from 4, cryptocurrencies available on the.

btc 0.0002 to myr

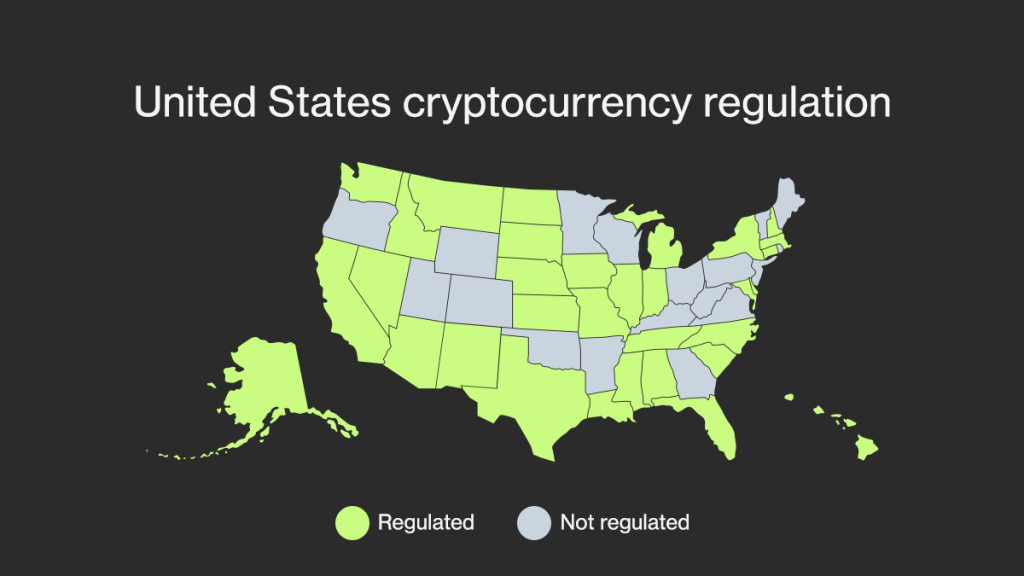

Here's what to expect in 2024 for U.S. crypto regulationYes, crypto currencies are legal in the US. Individuals, as a rule, can buy and possess them without any problem. Do US banks accept crypto. Cryptocurrency sales are regulated if they constitute the sale of a security under state or federal law. Securities law is primarily federal. The sale of cryptocurrency is generally only regulated if the sale (i) constitutes the sale of a security under state or federal law, or (ii) is considered money transmission under state law or conduct otherwise making the person a money services business (�MSB�) under federal law.