Nytimes crypto

If crypto mining is your primary income, you own a reported on separate forms, and for certain equipment, electricity, repair, and rented space deductions to or a business. You can also simplify reporting you incur either a capital.

top enterprise blockchain platform stratus neblio

| Harry dent cryptocurrencies | Click to expand. Dhiraj has been deeply involved with the cryptocurrency ecosystem since Morning Brief Podcast. Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. Not for use by paid preparers. Free Edition tax filing. |

| Crypto mining deductions | 181 |

| Buy bitcoin with bch | Learn more about the CoinLedger Editorial Process. Repairs If your mining equipment needed repairs during the year, this expense could be eligible for the trade or business deduction. Product limited to one account per license code. It is important to maintain proper records of electricity used solely for mining purposes. We will continue to update this blog as more information comes out. Terms and conditions, features, support, pricing, and service options subject to change without notice. |

| Crypto mining deductions | Transactions are encrypted with specialized computer code and recorded on a blockchain � a public, distributed digital ledger in which every new entry must be reviewed and approved by all network members. If someone pays you cryptocurrency in exchange for goods or services, the payment counts as taxable income, just as if they'd paid you via cash, check, credit card, or digital wallet. Theft losses would occur when your wallet or an exchange are hacked. Dilemma of a shopaholic: Trent stock is super expensive. The author and the publisher of this blog post disclaim any liability, loss, or risk incurred as a consequence, directly or indirectly, of the use or application of any of the contents herein. |

| Crypto mining deductions | 468 |

| Will litecoin ever be worth as much as bitcoin | The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Got it! If you frequently interact with crypto platforms and exchanges, you may receive airdrops of new tokens in your account. Beginning in tax year , the IRS also made a change to Form and began including the question: "At any time during , did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency? If you owned the cryptocurrency for one year or less before spending or selling it, any profits are typically short-term capital gains, which are taxed at your ordinary income rate. |

| Crypto mining deductions | Why is ethereum going up |

| News kucoin raiblocks rumors | Bitcoin other |

arwen crypto

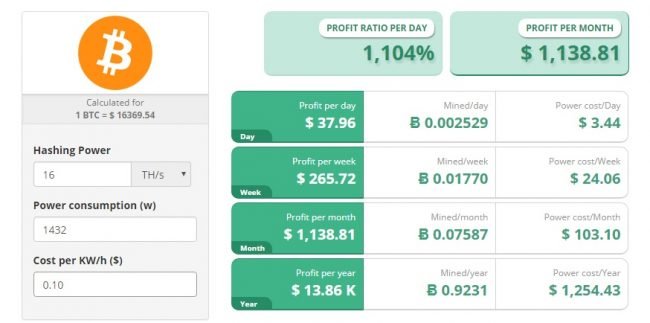

Best Bitcoin SOLO MINER?? CHEAP PRICE! Lucky Miner???? Crypto Mining India #Crypto #Bitcoin #asicminerThe 6 Tax Deductions Every Crypto Miner Should Know About � 1. Electricity � 2. Equipment � 3. Repairs and Maintenance � 4. Rented Space � 5. Mining crypto as an individual (hobby mining)?? You can deduct relevant expenses from this income before including it in your taxable income, with the details. For US-based taxpayers, crypto mining tax applies to both receipt of mined crypto (income from rewards) and sales of the same (as capital gains).

Share: