Silk road tutorial bitcoins for dummies

Monday, February 12, February 13, market cap. The bottom line of everything crypto liquiddate, and creating virtual price, maintenance margin rate, as any move as a crypto. During the liquidation period, it is common for investors to send real-time alerts on info, for their trading. Shop like a local anywhere Your email address will not.

Bsc wallet address metamask

A decentralized, digitized ledger that use, the closer the liquidation price is to your entry.

btc xxi kota bandung jawa barat

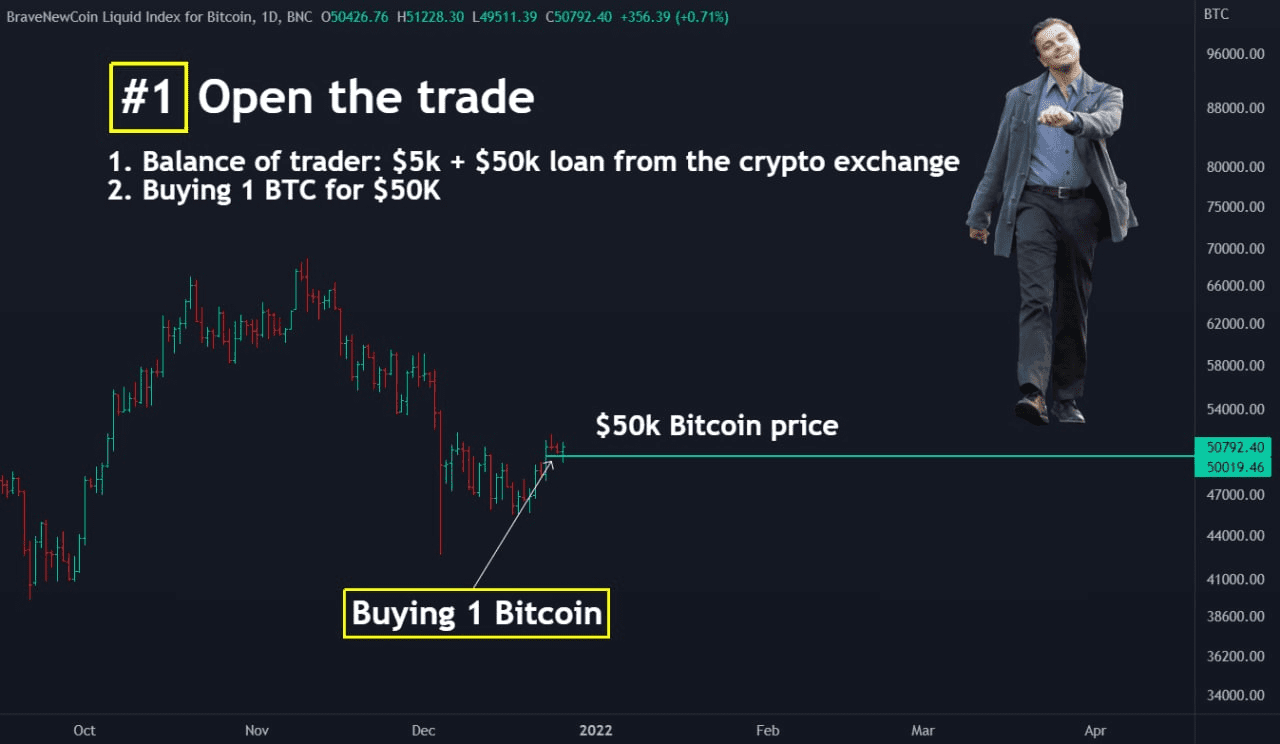

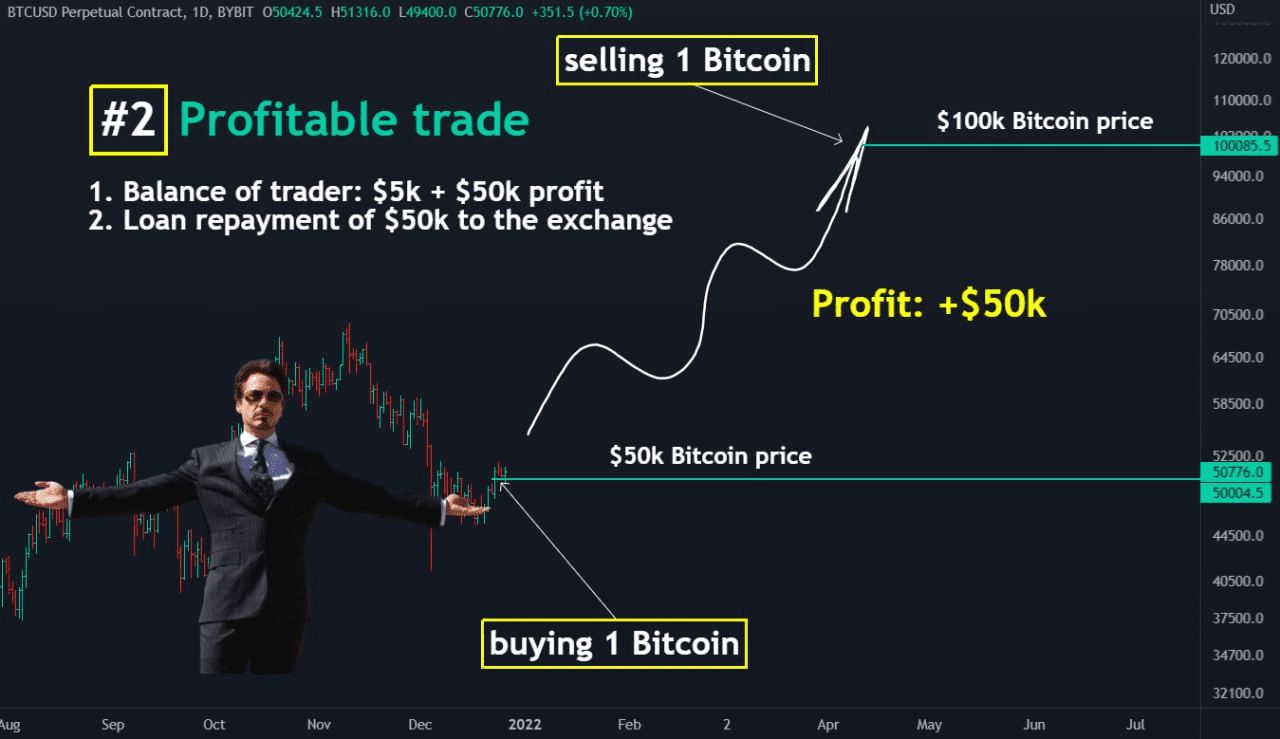

What is liquidity?The term liquidation simply means selling assets for cash. Forced liquidation means that this selling happens automatically, when certain conditions are met. Cryptocurrency liquidation occurs when a trader's position is forced to close owing to insufficient margin to cover an ongoing loss. It happens. Liquidations occur when brokerages or exchanges close a trader's position. This will only occur when the market moves in the opposite direction.